Written by:

6

Date:

Updated on:

What matters most for anyone trading crypto? Speed. When your data arrives late or your transaction hits the chain a second too slow, the opportunity is gone.

Many traders think about strategies, bots, or signals, but the real edge comes from what powers all of it behind the scenes—the infrastructure.

Trading infrastructure providers make sure your data streams in real time, your transactions land on-chain reliably, and your systems stay stable when markets go wild.

In this article, we will explore the core components of modern systems, what to look for in crypto trading infrastructure providers, and which platforms are powering the fastest trading setups in 2026.

Crypto trading infrastructure is the technical backbone that makes high-speed, high-volume trading possible. It includes everything that delivers market data, processes transactions, and ensures execution stays stable even during network congestion. Each component directly affects latency, reliability, and scalability.

This is the core layer where trading systems connect to blockchains.

Well-architected node clusters enable consistent high throughput and ultra-low response times.

Latency depends heavily on how fast data moves between systems.

This layer ensures data travels across the globe in milliseconds, giving traders the speed advantage.

Trading algorithms rely on fresh, accurate data streams.

This allows bots, market makers, and arbitrage systems to react before the competition does.

Once a transaction is ready, it must land on-chain reliably.

This component ensures your orders don’t get stuck, dropped, or delayed during traffic spikes.

Infrastructure must remain stable when load or market volatility peaks.

This guarantees that your trading systems stay online, even under extreme conditions.

Trading infrastructure providers like Dysnix power the invisible core of today’s digital markets. They enable teams to build, scale, and operate high-load trading systems without compromising speed, reliability, or security. This is critical for organizations whose business depends on instant execution, predictable latency, and always-on availability.

High-frequency trading teams operate at millisecond precision. Any latency spike or dropped transaction can ruin an arbitrage opportunity or break a market-making loop. These teams rely on:

Infrastructure becomes their competitive edge, if their systems react faster, they win the trade.

Market makers must maintain tight spreads and constant liquidity across multiple pairs and venues. Infrastructure downtime or inconsistent performance directly affects their profitability. They need:

With this setup, market makers can run continuous quoting engines and keep slippage near zero.

Trading platforms must process millions of user requests per day without service degradation. They require not only performance, but also stability and cost-efficiency at scale. Typical needs include:

This allows platforms to scale seamlessly as their user base grows.

Venture funds building a portfolio of blockchain projects need a secure and predictable environment for validators, testnets, and production systems. They usually rely on:

Such infrastructure reduces time-to-market for portfolio projects and lowers ongoing maintenance costs.

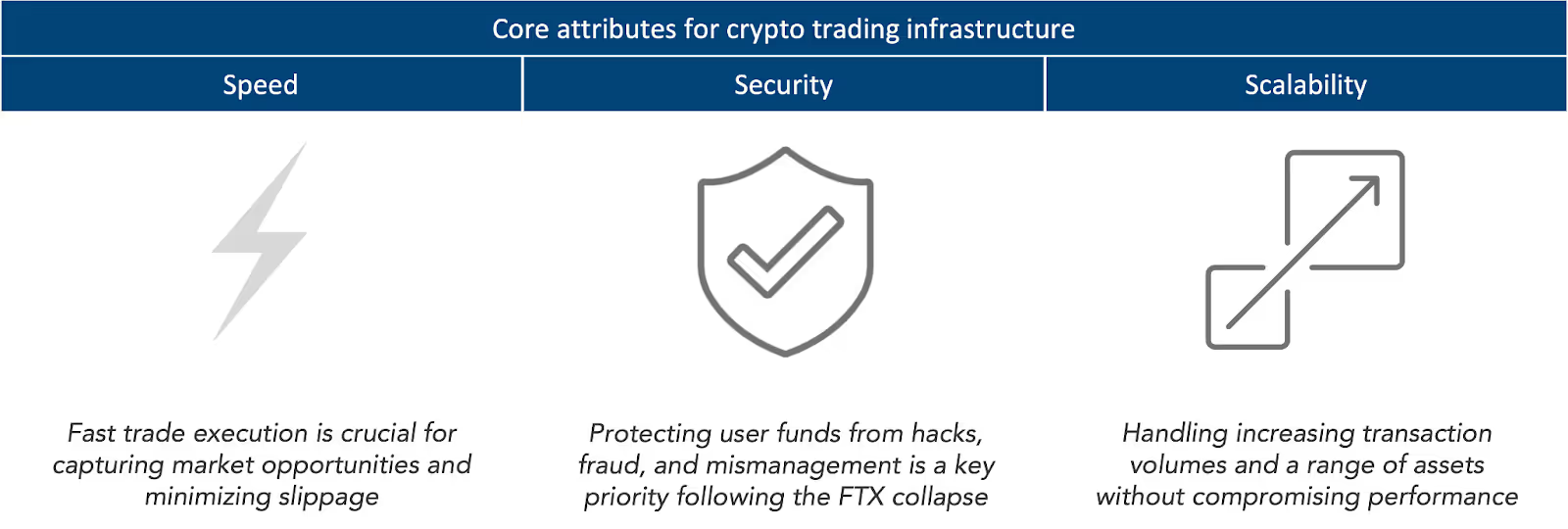

The infrastructure you build on will dictate how fast your orders hit the chain, how consistently your systems run under load, and how expensive it becomes to scale.

For high-frequency desks, DeFi platforms, and institutional teams, this decision often determines whether they can compete at all. The key is to evaluate providers by their technical foundations: latency, uptime, isolation, scalability, observability, and compliance. These factors directly shape how your infrastructure behaves in production and how much risk it carries.

| Criterion | What it means | Why it matters |

|---|---|---|

| Latency & throughput | Average and peak response time, measured in milliseconds; max requests/sec | Defines how quickly orders execute and how many can be processed in parallel |

| Uptime SLA | Guaranteed service availability (e.g. 99.9% or 99.99%) | Ensures infrastructure stays online during market volatility |

| Node isolation | Whether you get dedicated, private nodes or shared public ones | Prevents noisy neighbors from causing unpredictable delays |

| Scalability | Ability to handle load bursts, auto-scale clusters, and maintain stability | Critical during volume spikes and system growth |

| Observability | Metrics, logging, tracing, alerting, and real-time dashboards | Gives visibility into errors, bottlenecks, and performance trends |

| Geo distribution | Global node locations and routing optimizations | Reduces propagation delays for globally distributed users |

| Security & compliance | Certifications like ISO 27001 and SOC 2, plus security audits | Required for institutional adoption and safeguarding user assets |

The market is full of RPC and node providers, but only a few are built to handle the demands of high-frequency trading, market making, and institutional DeFi platforms. Most public endpoints collapse under peak loads, introduce unpredictable latency, or lack the security and observability needed at scale.

The providers below stand out because they deliver dedicated, low-latency infrastructure with guaranteed uptime and proven performance under heavy production workloads.

Dysnix is a battle-tested infrastructure provider built specifically for high-frequency trading teams, market makers, DeFi platforms, and venture funds. It delivers a dedicated, ultra–low-latency ecosystem designed to handle billions of requests per month with predictable performance, full observability, and compliance-first security.

The platform combines geo-distributed bare-metal clusters, cloud-based deployments, and custom DevOps support to give clients sub-4ms response times, 99.9% SLA-backed uptime, and zero rate limits. Every client runs on isolated infrastructure—no shared nodes, no noisy neighbors—ensuring stable latency even during network-wide traffic surges. With ISO 27001 and SOC 2 certifications, Dysnix meets institutional security standards while providing unmatched flexibility for scaling.

| Pros | Cons |

|---|---|

| Purpose-built architecture optimized for high-frequency trading logic | — |

| Private network topology ensuring deterministic latency under peak load | — |

| Integrated security layers including sentry nodes and protected endpoints | — |

| Automated infrastructure scaling driven by live business metrics | — |

| Native support for validator-grade deployments and slashing-risk protection | — |

| Real-time performance tuning and proactive incident prevention | — |

Helius is a Solana-focused infrastructure provider known for its ultra-fast data delivery and developer-oriented APIs. It operates high-performance RPC clusters designed to give trading teams, market makers, and analytics platforms instant access to real-time blockchain activity.

The platform offers both shared and dedicated Solana nodes deployed in geographically distributed data centers to minimize latency. Its architecture includes specialized streaming systems like ShredStream and Geyser-powered pipelines for block-level and mempool-level visibility. Helius integrates gRPC and WebSocket endpoints for sub-second data propagation and supports custom webhooks for on-chain event triggers, which are critical for building low-latency algorithmic trading pipelines. It also provides advanced developer tooling such as transaction decoders, indexing frameworks, and enriched block data feeds to accelerate product development.

| Pros | Cons |

|---|---|

| Real-time block and transaction streaming via ShredStream and Geyser | Focused solely on Solana, lacks multi-chain support |

| Geo-distributed clusters reducing propagation delays to sub-10ms | Higher cost for fully dedicated infrastructure |

| Integrated gRPC and WebSocket endpoints for ultra-fast data delivery | No built-in validator deployment or infrastructure customization |

| Advanced developer tooling for indexing, decoding, and data enrichment | Limited operational observability compared to enterprise-grade platforms |

| High success rate and reliability under heavy read workloads | |

| Dedicated nodes available for low-latency trading and bot operations |

QuickNode is a multi-chain infrastructure provider that delivers high-performance RPC access across more than 25 blockchains, including Solana, Ethereum, BNB Chain, Polygon, and Avalanche. It is widely used by trading platforms and DeFi projects that require fast response times, stable global availability, and rich developer tooling.

QuickNode runs globally distributed node clusters with Anycast-based routing to connect clients to the closest endpoint, reducing round-trip latency to 8–12 ms on average. It offers both shared and dedicated nodes, as well as access to archive data for historical state queries and backtesting. The platform supports advanced streaming via WebSockets, gRPC, and custom Webhooks, enabling real-time order book and mempool data ingestion. For Solana specifically, QuickNode integrates Jito bundles and priority fee APIs, which help algorithmic traders push transactions into blocks faster than standard public nodes.

| Pros | Cons |

|---|---|

| Supports 25+ blockchains with unified APIs and SDKs | Shared nodes can cause variable latency during peak usage |

| Anycast routing and global edge network delivering 8–12 ms average latency | Costs scale sharply at high request volumes |

| Dedicated and archive nodes available for heavy trading or analytics loads | Lacks deep customization of infrastructure topology |

| Real-time streaming APIs: WebSockets, gRPC, and Webhooks | No validator-grade deployments or slashing-risk protection |

| Jito bundles and priority fee APIs for faster Solana transaction inclusion | Requires manual rate-tier upgrades for extreme HFT workloads |

| Built-in observability with logs, metrics, and tracing |

Alchemy is an enterprise-grade multi-chain infrastructure platform known for its stability, rich developer ecosystem, and advanced observability. It powers major exchanges, DeFi platforms, and institutional trading systems by providing reliable, scalable access to networks like Ethereum, Polygon, Arbitrum, Optimism, and Base.

The platform operates high-availability node clusters deployed across multiple geographic regions with automatic failover and load balancing to ensure consistent sub-20 ms latency. Alchemy provides dedicated and shared nodes, archive access for full historical state queries, and high-throughput RPC endpoints capable of handling tens of millions of daily requests. Its enhanced APIs—including Alchemy Webhooks, Transact API, and Mempool API—allow real-time monitoring of pending transactions and fine-grained control of transaction submission pipelines, which are critical for algorithmic trading strategies.

| Pros | Cons |

|---|---|

| Global high-availability node clusters with automatic failover | Less optimized for ultra-low latency HFT workloads |

| Archive and dedicated node support for deep historical data access | Can become expensive at very high request volumes |

| Enhanced APIs for mempool access, transaction simulation, and submission | No custom hardware topology or private network isolation |

| Advanced observability: debugging, tracing, request replay, usage analytics | Limited direct support for validator-grade infrastructure |

| Enterprise console with RBAC, quotas, and alerting for large teams | Latency slightly higher than niche Solana-focused providers |

| Proven reliability powering major institutional DeFi and CeFi platforms |

Blockdaemon is one of the largest institutional-grade infrastructure providers, supporting over 60 blockchains with a focus on security, compliance, and operational stability. It is used by exchanges, custodians, and large trading firms that require enterprise SLAs, robust validator hosting, and deep historical data access alongside RPC endpoints.

The platform runs globally distributed bare-metal and cloud clusters with automated failover, cross-region redundancy, and built-in DDoS protection. Blockdaemon offers dedicated RPC nodes, validator-as-a-service deployments, staking infrastructure, and archive nodes for full historical state access. Its nodes are deployed inside isolated private networks with hardware security modules (HSMs) for key protection, meeting the requirements of financial institutions.

Blockdaemon also provides institutional features like SOC 2 Type II and ISO 27001 certification, detailed SLA contracts, and advanced telemetry including real-time performance metrics, alerting, and audit logs. It supports throughput levels of hundreds of millions of requests per day while maintaining predictable response times under heavy load.

| Pros | Cons |

|---|---|

| Supports 60+ blockchains with both RPC and validator infrastructure | Higher cost barrier compared to developer-focused platforms |

| Enterprise-grade security: HSM key management, SOC 2 Type II, ISO 27001 | Latency typically higher than HFT-focused providers |

| Cross-region failover and automated self-healing node clusters | Limited customization of runtime environments |

| Dedicated RPC, validator, and archive nodes for institutional workflows | Less flexible for short-term or experimental workloads |

| Detailed SLA contracts and audit-ready monitoring & logging | No built-in mempool priority or MEV-focused tooling |

| Proven reliability powering exchanges, custodians, and financial services |

Ankr is a globally distributed, decentralized infrastructure network designed to provide cost-efficient RPC access across more than 40 blockchains, including Ethereum, BNB Chain, Polygon, and Avalanche. It targets projects that need to serve high request volumes without the overhead of managing infrastructure directly.

The platform operates a network of independent node operators spread across multiple continents, coordinated through Ankr’s load-balancing layer. This setup allows it to absorb massive traffic peaks while keeping average response times around 15–20 ms. Ankr offers public shared RPC endpoints, private dedicated nodes for performance-sensitive applications, and archive nodes for complete historical data. Its platform includes automatic load scaling, rate limit configuration, and real-time metrics via Ankr Monitoring.

| Pros | Cons |

|---|---|

| Supports 40+ blockchains through a unified decentralized network | Shared endpoints can experience variable latency |

| Cost-efficient architecture for high-volume workloads | Limited customization of underlying infrastructure |

| Globally distributed node operators reducing regional bottlenecks | Lower operational transparency compared to enterprise-focused providers |

| Offers both public RPC and dedicated node options | No advanced mempool priority or MEV-focused tooling |

| Includes staking and validator hosting alongside RPC access | SLA guarantees weaker than institutional-grade platforms |

| Built-in monitoring and automated scaling features |

NOWNodes is a developer-friendly infrastructure platform offering RPC and WebSocket access to over 60 blockchains, including Ethereum, Bitcoin, BNB Chain, and Polygon. It is primarily aimed at projects that need fast setup, predictable performance, and stable API endpoints without running their own nodes.

The service provides both shared public RPC endpoints and private dedicated nodes with response times around 20–25 ms, plus archive node support for full historical data. NOWNodes operates data centers in multiple regions with load balancing to maintain stable availability, and it offers a guaranteed SLA of 99.95%. It includes built-in monitoring dashboards, usage analytics, and a simplified API layer for quick integration into trading backends, analytics platforms, or DeFi frontends.

While it lacks some of the advanced customization and performance tuning of enterprise-grade providers, it is known for rapid deployment and predictable pricing models suitable for growing teams.

| Pros | Cons |

|---|---|

| Supports 60+ blockchains with unified RPC and WebSocket APIs | Latency slightly higher (~20–25 ms) than HFT-focused providers |

| Provides both shared and dedicated node options | Lacks advanced mempool priority or MEV-focused tooling |

| SLA-backed 99.95% uptime with regional load balancing | Limited customization of infrastructure topology |

| Archive nodes for full historical state access | Lower throughput ceiling compared to enterprise solutions |

| Built-in monitoring dashboards and usage analytics | |

| Very fast onboarding and predictable pricing |

The best way to evaluate infrastructure is to see how it behaves when markets get intense, traffic skyrockets, and every millisecond counts.

Take PancakeSwap, the #1 DEX on BNB Chain, processing over 2 billion requests every single day. Before migrating to Dysnix, their public endpoints couldn’t keep up: infrastructure costs were climbing above $200K per month, users faced ~3.2 seconds of latency spikes during peak hours, and regular downtimes broke transaction flows.

With Dysnix, they switched to dedicated, geo-distributed clusters tuned for ultra-low latency. As a result, their infrastructure costs dropped by 70%, peak response time improved 62.5×, and they stabilized at 158+ billion monthly requests with ~99.9% uptime, while keeping average latency around 80 ms even at full load.

This is what a true trading infrastructure provider should deliver: predictable performance at scale, isolation from network noise, and complete operational control, so your trading systems stay ahead while others are still waiting for blocks to load.