There are many ways to reduce cloud spend, but the only sustainable one is to make spend predictable, attributable, and decision‑driven.

In 2026, FinOps is about running cloud like a product: every workload has an owner, every dollar maps to a unit metric, and every spike has an explainable cause. Done well, FinOps becomes a growth and reliability control plane—protecting runway without slowing shipping.

Let’s break down the FinOps meaning, its evolution, and how to harness its power for your project.

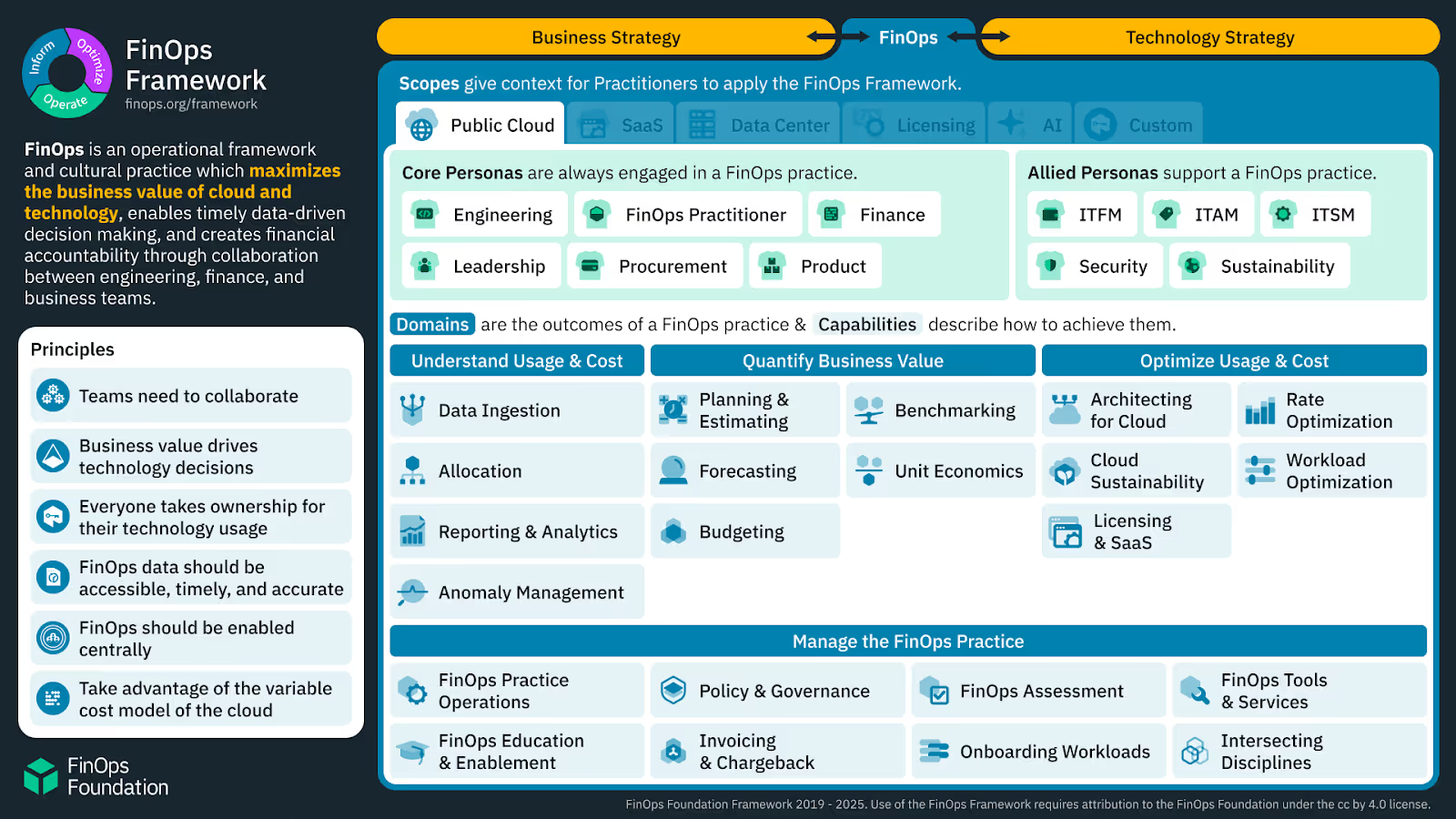

FinOps is an operating model that aligns Engineering, Finance, and Product around measurable cloud value.

It combines near‑real‑time cost visibility, clear ownership, and lightweight governance so teams can make tradeoffs quickly: performance vs cost, reliability vs commitments, experimentation vs budget. The point isn’t to minimize spend—it’s to maximize outcomes per dollar.

Goal of FinOps: Align engineering, finance, and business teams for real-time visibility and accountability in cloud spending.

For Seed+ CTOs, FinOps answers three questions investors and operators ask repeatedly:

The FinOps framework is a cultural practice that enables cross-functional teams to collaborate on data-driven spending decisions. In many scaling teams, FinOps becomes the link between fast delivery and financial accountability—so innovation stays predictable instead of turning into recurring surprise bills.

Cloud FinOps is about more than cost optimization. It’s about business value realization—aligning investments with strategic goals, accelerating time-to-market, and enabling innovation without financial surprises.

The term itself was first coined by J.R. Storment and Mike Fuller in 2019. They were the co-founders of the FinOps Foundation, the leading institution related to this framework, which was established as a part of the Linux Foundation.

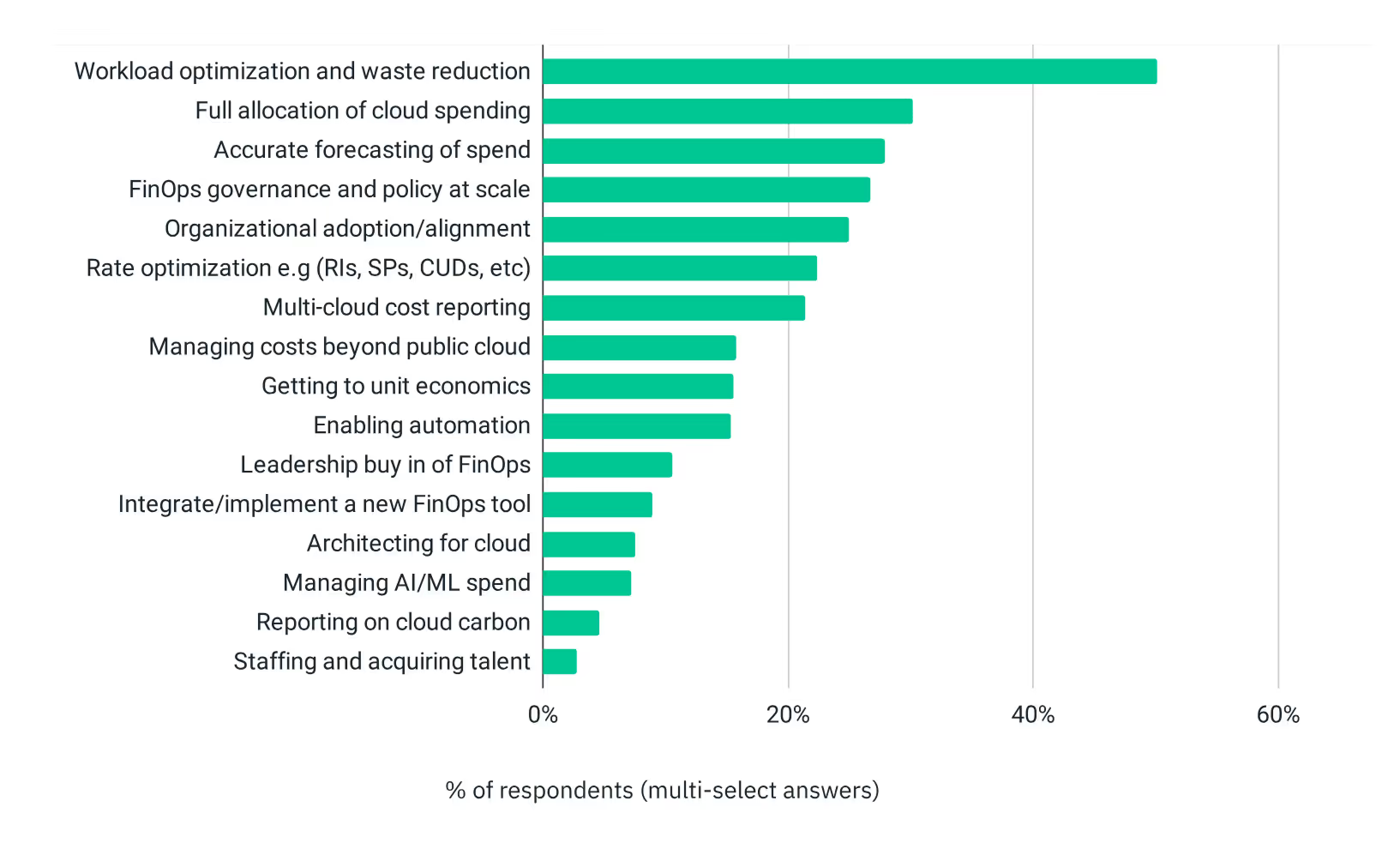

Here are the key trends shaping cloud financial operations in 2025:

Organizations are moving from tracking aggregate cloud spend to understanding the cost per customer, transaction, or feature. This unit economics approach enables precise business value realization and helps teams tie investments directly to revenue and growth metrics.

The focus is no longer just on slashing costs. Modern financial strategies prioritize maximizing return on investment (ROI), ensuring every dollar spent in the cloud drives measurable business outcomes. This shift aligns financial operations with strategic business goals.

Tools and accelerators powered by AI are automating anomaly detection, forecasting, and rightsizing, freeing up teams to focus on strategic decisions. Here are a few tools for you to know about:

| Tool | Core focus | AI/ML functions | Key strengths | Supported Clouds | Notable integrations/features |

|---|---|---|---|---|---|

| CloudHealth by VMware | Cost management, governance, optimization | Anomaly detection, predictive analytics, automated recommendations | Enterprise-grade governance, policy automation, multi-cloud support | AWS, Azure, GCP, Oracle, VMware | Policy management, security compliance, reporting |

| Apptio Cloudability | Cost visibility, optimization, forecasting | ML-based forecasting, waste detection, optimization recommendations | Granular cost allocation, strong reporting, business mapping | AWS, Azure, GCP | Business mapping, showback/chargeback, integrations with ITFM |

| Densify | Resource optimization, rightsizing | Predictive analytics for workload patterns, automated rightsizing | Deep optimization for VMs/containers, performance/cost balance | AWS, Azure, GCP, IBM, VMware | Container optimization, integration with IaC tools |

| ProsperOps | Automated savings (RIs/SPs) | AI-driven automation for RI/SP management, continuous optimization | Fully automated savings, hands-off management, real-time adjustments | AWS | Automated buying/selling of RIs/SPs, savings analytics |

| Anodot | Anomaly detection, spend monitoring | AI-powered anomaly detection, real-time alerts, spend forecasting | Fast detection of spend anomalies, real-time alerts, broad data source support | AWS, Azure, GCP, others | Integrates with BI tools, customizable alerting |

Short conclusions and advice:

But tooling doesn’t create FinOps maturity—operating cadence and ownership do. Use tools to automate what your team already agrees to measure and enforce. When choosing tooling, prioritize these capabilities over brand names:

Start with native cloud billing + budgets + allocation. Buy additional tooling when manual processes repeat weekly and become a bottleneck.

FinOps is being embedded directly into DevOps pipelines. By integrating with CI/CD and IaC workflows, teams can enforce cost controls and policies automatically at every stage of the software delivery lifecycle. This proactive approach prevents overspending before it happens.

The fastest way to control cloud costs is to move checks left—into pull requests, Terraform plans, and deployment pipelines. Practical FinOps-as-Code guardrails include:

The goal is not to block engineers—it’s to make cost impact visible at decision time.

Policy-as-Code enables organizations to define and enforce cloud financial policies programmatically. This ensures compliance, governance, and cost controls are consistently applied across all resources, reducing manual errors and financial risk.

Taking PaC further, FinOps-as-Code embeds financial best practices directly into code repositories and deployment pipelines. This approach automates cost allocation, tagging, and optimization, making cost management a seamless part of the development process.

Sustainability reporting is useful when it drives concrete tradeoffs. If your org tracks carbon, integrate it the same way you integrate cost: by workload, by environment, and by unit metric. Treat sustainability as a constraint alongside latency, reliability, and budget—otherwise it becomes dashboard theater.

Web3 and blockchain projects require decentralized, transparent financial operations. Decentralized FinOps leverages smart contracts and on-chain analytics to automate cost allocation, enforce budgets, and provide real-time financial accountability in distributed environments.

As multi-cloud adoption grows, so does the complexity of cost management. Unified FinOps cloud platforms are emerging to provide a single pane of glass across AWS, Azure, GCP, and private clouds.

In 2026, “the cloud bill” rarely lives in one place. Mature FinOps programs track and optimize:

If you only optimize EC2/VMs, you’ll miss the fastest‑growing spend categories.

Why invest in the new framework for financial operations? Here’s what C-level leaders are seeing:

Successful FinOps cloud cost management is built on a few core principles:

Fintechs operate in highly regulated, cost-sensitive environments. FinOps services help them balance innovation with compliance, using real-time dashboards and automated policies to prevent overspending.

For example, a neobank can use FinOps to cut cloud costs while maintaining PCI DSS compliance.

Characteristics:

Priorities:

Web3 startups face volatile workloads and unpredictable growth. FinOps cloud practices enable dynamic scaling and cost allocation, ensuring that token launches or NFT drops don’t break the bank.

Dysnix’s work with blockchain projects shows how FinOps can support both transparency and agility.

Characteristics:

Priorities:

AI/ML workloads are notorious for unpredictable costs. FinOps in cloud environments helps teams monitor GPU usage, optimize training pipelines, and forecast spend.

Characteristics:

Priorities:

AI spend behaves differently from traditional web workloads: GPUs are expensive, bursty, and easy to underutilize. A 2026 FinOps baseline for AI-heavy teams includes:

Days 0–30: Make costs attributable

Days 31–60: Create repeatable controls

Days 61–90: Move control into engineering workflows

Thus, you learnt more about the new operating model for finance in the cloud era. The robust FinOps cloud cost management helps you stay afloat during market challenges and technological disruptions, giving hints on where financial flows can be redistributed.

Whether you’re in fintech, web3, or AI/ML, the time to invest in FinOps is now.